You Are On Multi Choice Question Bank SET 4454

222702. Which of the following sequences of location represent Alok, Kabeer, Anup, Rahul, Raghu, and Amit in the same order?

222703. People who have e-mail account with Indiatimes, Sancharnet and Yahoo work for which companies, in the same sequence as the e-mail accounts mentioned?

222704. How many ‘zeroes’ are there in the following sequence which are immediately preceded by a nine but not immediately followed by seven? 7090070890702030045703907

222705. A Retail chain has seven branches in a city namely R1, R2, R3, R4, R5, R6, R7 and a central distribution center (DC). The nearest branch to the DC is R6 which is in the south of DC and is 9 Km away from DC. R2 is 17 Km away from DC in the west. The branch R1 is 11 Km away R2 further in the west. The branch R3 is 11 Km in the north east of R1. R4 is 13 Km from R3 in the east. R5 is 11 Km in the north east of the distribution center. In the north east of R6 is R7 and distance between them is 15 Km. The distance between R1 and R6, R2 and R6, R6 and R5 is 23 Km, 19 Km, 13 Km respectively. R3 is 14 Km away from the DC in the north west direction, while R2 is also 14 Km away from R4 in the north east direction of R2. A truck carrying some goods starts from the distribution center and has to cover at least four stores in a single trip. There is an essential good that has to be delivered in the store R7, but the delivery at R7 has to be done in the end, so what is the shortest distance the truck would travel?

222706.

Following graph represents the cost per square feet of four retailers from the financial year 2004 to 2012. The expected cost per square feet for year 2010, 2011 and 2012 are fore casted figures.

Which retailer shows the sharpest decline in cost per square feet and in which year?

Which retailer shows the sharpest decline in cost per square feet and in which year?

222707. Which retailer has shown the maximum increase in its cost per square feet and in which year?

222708. What is the average rate of change in the cost per square feet of the retail sector, if the sector is represented by the above four retailers in the period FY07 to FY10E?

222709.

The table below represents the information collected by TRAI about the Service Area wise Access of (Wireless + Wire line) subscribers in India. On the basis of the information provided in the table answer the questions that follow.

Which service area has observed maximum rate of change from Dec 2009 to March 2010 (in percentage)?

Which service area has observed maximum rate of change from Dec 2009 to March 2010 (in percentage)?

222710. As a result of a decisions to allow only two or three telecom operator in a particular service area, TRAI allocates R-Com and Vodafone to operate only in the east of India and Idea and Airtel operate only in south. R-Com has got 28% subscribers in the east while Vodafone has 72% subscribers; similarly Idea has 48% subscribers in the south while Airtel has 52% subscribers. How many subscribers do these four players have in 2010?

222711. Due to operability issues early in 2010 Madhya Pradesh and entire UP was added to the eastern telecom circle. The telecom operators in Madhya Pradesh and entire UP namely R-Com, Vodafone and Idea had 28%, 40% and 32% subscribers respectively. What is the percentage of subscribers that each player has in the newly formed eastern circle in March 2010?

222713.

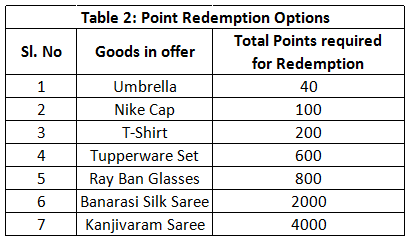

In order to quantify the intangibles and incentives to the multi brand dealers (dealers who stock multiple goods as well as competing brands) and the associated channel members, a Company(X) formulates a point score card, which is called as brand building points. This brand building point is added to the sales target achieved points for redemption. The sales target achieved point is allotted as per the table 3 of this question. The sum of brand building point and sales achieved points is the total point that can be redeemed by the dealer against certain goods, as shown in the second table.

The detail of the system is shown in the tables below

There are 10 multi brand dealers in Nasik and the sales that they have achieved in the end of a quarter are:

There are 10 multi brand dealers in Nasik and the sales that they have achieved in the end of a quarter are:

Maheshwari & Co has Company X signage along with other brand signage in the main entrance of the store, the exterior walls of the store have the painting of only company X, the side wall in the interior has the painting of Company X. The POP display of Company X is above the eye level with other brands while the stacking of goods of Company X is in the back row of the shelves. The brand building points when combined with the sales achieved points amounts to the total points that a dealer can accumulate in a quarter. The number of Tupperware Sets that Maheshwari & Co can redeem after the quarter (July to September) is?

Maheshwari & Co has Company X signage along with other brand signage in the main entrance of the store, the exterior walls of the store have the painting of only company X, the side wall in the interior has the painting of Company X. The POP display of Company X is above the eye level with other brands while the stacking of goods of Company X is in the back row of the shelves. The brand building points when combined with the sales achieved points amounts to the total points that a dealer can accumulate in a quarter. The number of Tupperware Sets that Maheshwari & Co can redeem after the quarter (July to September) is?

222714. Bhowmik Brothers has only other brands signage in the front of the store, and company X painting on the side wall in the exterior of the store, Company X painting on the side wall in the interior of the store, no POP display of any Company and the goods of Company X is stacked in the front row with other brands. What is the total point Bhowmik Brothers need to accumulate to make them eligible for minimum redemption?

222715. The Brand building points of Saha H/W is 85, and Mr. Saha the proprietor of the store wants to redeem a Kanjivaram Saree the next quarter by carrying forward the points accumulated this quarter to the next quarter. The sales target of Saha H/W is 25,000 units in the next quarter. It is assumed the brand building points for the next quarter is also going to be 85. How many extra units Saha H/W has to sell in order to get the Kanjivaram Saree?

222716. Malling Enterprise exhausted all its points while redeeming three Nike Caps and an Umbrella, what is its brand building points?

222717. If Srikrishna Trader has 80 brand building points then the goods that it can redeem are _________?

222718.

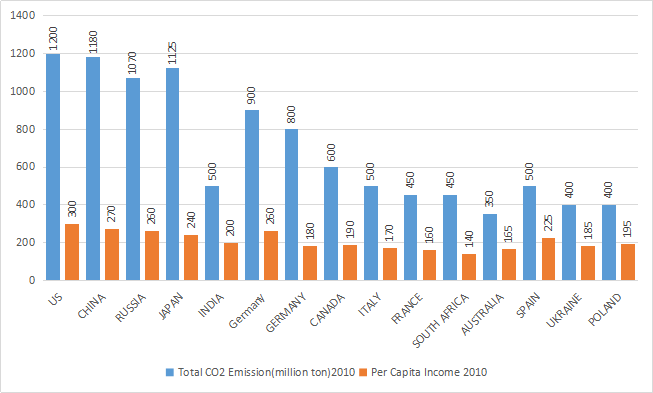

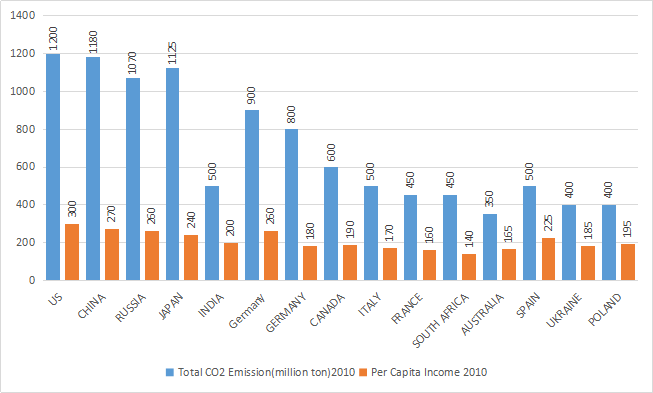

Study the following graph and answer the questions that follow

If the world energy council formulates a norm for high emission countries to reduce their emission each year by 12.5% for the next two years then what would be the ratio of $$CO_2$$ emission to per capita income of US, China and Japan after two years. The per capita income of China, Japan and US is expected to increase every year by 4%, 3% and 2% respectively.

If the world energy council formulates a norm for high emission countries to reduce their emission each year by 12.5% for the next two years then what would be the ratio of $$CO_2$$ emission to per capita income of US, China and Japan after two years. The per capita income of China, Japan and US is expected to increase every year by 4%, 3% and 2% respectively.

222719.

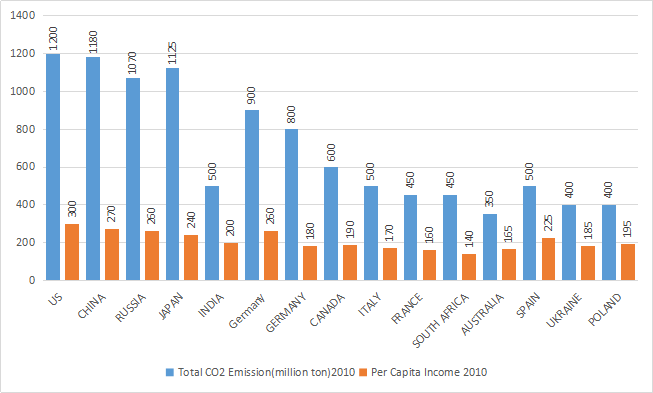

Study the following graph and answer the questions that follow

If US and China, decide to buy carbon credits, from Spain and Ukraine to make up for their high emissions, then in how many years US, and China would be able to bring down its ratio of $$CO_2$$ emission (million ton) to per capita income to world standard benchmark of 0.75. (per capita income of the given countries remain same, 0.5 $$CO_2$$ emissions [million ton] is compensated by purchase of 1.25 units of carbon credit, and a country can buy carbon credit units in three lots of 15, 20 and 30 units in a single year.)

If US and China, decide to buy carbon credits, from Spain and Ukraine to make up for their high emissions, then in how many years US, and China would be able to bring down its ratio of $$CO_2$$ emission (million ton) to per capita income to world standard benchmark of 0.75. (per capita income of the given countries remain same, 0.5 $$CO_2$$ emissions [million ton] is compensated by purchase of 1.25 units of carbon credit, and a country can buy carbon credit units in three lots of 15, 20 and 30 units in a single year.)

222720.

Study the following graph and answer the questions that follow

France, South Africa, Australia, Ukraine and Poland form an energy consortium which declares $$CO_2$$ emission of 350 million ton per annum as standard benchmark. The energy consortium decides to sell their carbon emission savings against the standard benchmark to high carbon emission countries. It is expected that the per capita income of each country of the energy consortium increases by 2%, 2.5% and 3.5% p.a. for the next three years respectively. The ratio of $$CO_2$$ emission to per capita income of the each energy consortium country reduces by 50% and remains constant for the next three years. By selling 0.5 $$CO_2$$ emissions [million ton] the energy consortium earns 1.25 carbon credits, then determine the total carbon credits earned by energy consortium in three years.

France, South Africa, Australia, Ukraine and Poland form an energy consortium which declares $$CO_2$$ emission of 350 million ton per annum as standard benchmark. The energy consortium decides to sell their carbon emission savings against the standard benchmark to high carbon emission countries. It is expected that the per capita income of each country of the energy consortium increases by 2%, 2.5% and 3.5% p.a. for the next three years respectively. The ratio of $$CO_2$$ emission to per capita income of the each energy consortium country reduces by 50% and remains constant for the next three years. By selling 0.5 $$CO_2$$ emissions [million ton] the energy consortium earns 1.25 carbon credits, then determine the total carbon credits earned by energy consortium in three years.

222721.

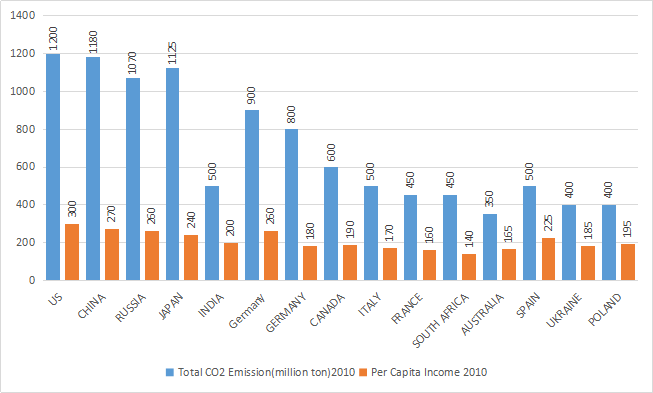

Study the following graph and answer the questions that follow

Select the wrong statement in reference to the position of India vis-à-vis other countries in the graph in terms of the ratio of $$CO_2$$ emission to per capita income (increasing order).

Select the wrong statement in reference to the position of India vis-à-vis other countries in the graph in terms of the ratio of $$CO_2$$ emission to per capita income (increasing order).

222722.

Refer to the following pie chart and answer the question that follows. The chart shows the number of units produced in degrees, by Company X in different States of India for the quarter July-Sep 2010.

By how many units does the number of units produced in Bihar exceed the number of units produced in Madhya Pradesh, if the total production in the quarter is 72, 000 units?

By how many units does the number of units produced in Bihar exceed the number of units produced in Madhya Pradesh, if the total production in the quarter is 72, 000 units?

222723.

The following graph shows population data (males and females), educated people data (males and females) and number of male in the population for a given period of 1995 to 2010. All data is in million.From the information given in the graph answer the questions that follow

In which year the percentage increase in the number of females over the previous year is highest?

In which year the percentage increase in the number of females over the previous year is highest?

222724. In 2002 if the ratio of number of educated male to professionally educated female was 5:4. If the number of educated males increased by 25% in 2003. What is the percentage change in number of uneducated females in 2003?

222725. In year 2005 total population living in urban area is equal to sixty eight percent of educated population. The ratio of number of people living in urban area to people living in rural area is 43:12 in 2010. What is the ratio of the rural population in 2005 to that in 2010?

222726. As per the passage which of the following statements truly reflects the real theme of' the passage?

222727. Which of the following statements is not true? I. Kodak bought sterling drug as a strategic choice for a chemical business as it was already in the business of chemically treated photo paper. II. The chemical business was in sync with the existing business of Kodak running across the customer segment, delivery channels and the regulatory environment. III. Kodak committed a mistake by selling sterling in pieces at a loss of 50%. IV. Kodak’s diversification attempt with purchase of sterling to strengthen its core business and shift to digital world was a shift from its strategic focus.

222728. Kodak lost a big piece of its market share to its competitors because of the following best explained reason. I. When Carp became the CEO the digital Technology eclipsed film technology business and further Carp had been with the company for twenty nine years and had no background in technology. II. Carp in 2004 introduced a film camera that won camera of the year award, yet it was discontinued by the time Kodak collected the award. III. Kodak moved from traditional retail photo processing systems into digital world installing several thousands of image magic kiosks that failed to deliver real benefits to the customers. IV. Phillipe Kahn led the advent of cell phone camera and Kodak lost out on the print business and ability to share images became a free feature with no additional charge.

222729. Arrange the given statements in the correct sequence as they appear in the passage. I. Kodak lost to its competitors a big pie of its market share. II. Kodak ventured into chemical business to strengthen its digital technology business. III. Kodak downsized its workforce drastically. IV. Kodak tied up with business firms for photo processing.

222731. People are continually enticed by such "hot" performance, even if it lasts for brief periods. Because of this susceptibility, brokers or analysts who have had one or two stocks move up sharply, or technicians who call one turn correctly, are believed to have established a credible record and can readily find market followings. Likewise, an advisory service that is right for a brief time can beat its drums loudly. Elaine Garzarelli gained near immortality when she purportedly "called" the 1987 crash. Although, as the market strategist for Shearson Lehman, her forecast was never published in a research report, nor indeed communicated to its clients, she still received widespread recognition and publicity for this call, which was made in a short TV interview on CNBC. Still, her remark on CNBC that the Dow could drop sharply from its then 5300 level rocked an already nervous market on July 23, 1996. What had been a 40-point gain for the Dow turned into a 40-point loss, a good deal of which was attributed to her comments.The truth is, market-letter writers have been wrong in their judgments far more often than they would like to remember. However, advisors understand that the public considers short-term results meaningful when they are, more often than not, simply chance. Those in the public eye usually gain large numbers of new subscribers for being right by random luck. Which brings us to another important probability error that falls under the broad rubric of representativeness. Amos Tversky and Daniel Kahneman call this one the "law of small numbers.". The statistically valid "law of large numbers" states that large samples will usually be highly representative of the population from which they are drawn; for example, public opinion polls are fairly accurate because they draw on large and representative groups. The smaller the sample used, however (or the shorter the record), the more likely the findings are chance rather than meaningful. Yet the Tversky and Kahneman study showed that typical psychological or educational experimenters gamble their research theories on samples so small that the results have a very high probability of being chance. This is the same as gambling on the single good call of an advisor. The psychologists and educators are far too confident in the significance of results based on a few observations or a short period of time, even though they are trained in statistical techniques and are aware of the dangers.Note how readily people over generalize the meaning of a small number of supporting facts. Limited statistical evidence seems to satisfy our intuition no matter how inadequate the depiction of reality. Sometimes the evidence we accept runs to the absurd. A good example of the major overemphasis on small numbers is the almost blind faith investors place in governmental economic releases on employment, industrial production, the consumer price index, the money supply, the leading economic indicators, etc. These statistics frequently trigger major stock- and bond-market reactions, particularly if the news is bad. Flash statistics, more times than not, are near worthless. Initial economic and Fed figures are revised significantly for weeks or months after their release, as new and "better" information flows in. Thus, an increase in the money supply can turn into a decrease, or a large drop in the leading indicators can change to a moderate increase. These revisions occur with such regularity you would think that investors, particularly pros, would treat them with the skepticism they deserve. Alas, the real world refuses to follow the textbooks. Experience notwithstanding, investors treat as gospel all authoritative-sounding releases that they think pinpoint the development of important trends. An example of how instant news threw investors into a tailspin occurred in July of 1996. Preliminary statistics indicated the economy was beginning to gain steam. The flash figures showed that GDP (gross domestic product) would rise at a 3% rate in the next several quarters, a rate higher than expected. Many people, convinced by these statistics that rising interest rates were imminent, bailed out of the stock market that month. To the end of that year, the GDP growth figures had been revised down significantly (unofficially, a minimum of a dozen times, and officially at least twice). The market rocketed ahead to new highs to August l997, but a lot of investors had retreated to the sidelines on the preliminary bad news. The advice of a world champion chess player when asked how to avoid making a bad move. His answer: "Sit on your hands”. But professional investors don't sit on their hands; they dance on tiptoe, ready to flit after the least particle of information as if it were a strongly documented trend. The law of small numbers, in such cases, results in decisions sometimes bordering on the inane. Tversky and Kahneman‘s findings, which have been repeatedly confirmed, are particularly important to our understanding of some stock market errors and lead to another rule that investors should follow.Which statement does not reflect the true essence of the passage? I. Tversky and Kahneman understood that small representative groups bias the research theories to generalize results that can be categorized as meaningful result and people simplify the real impact of passable portray of reality by small number of supporting facts. II. Governmental economic releases on macroeconomic indicators fetch blind faith from investors who appropriately discount these announcements which are ideally reflected in the stock and bond market prices. III. Investors take into consideration myopic gain and make it meaningful investment choice and fail to see it as a chance of occurrence. IV. lrrational overreaction to key regulators expressions is same as intuitive statistician stumbling disastrously when unable to sustain spectacular performance.

222732. The author of the passage suggests the anomaly that leads to systematic errors in predicting future. Which of the following statements does not best describe the anomaly as suggested in the passage above? I. The psychological pressures account for the anomalies just like soothsayers warning about the doomsday and natural disasters and market crashes. II. Contrary to several economic and financial theories investors are not good intuitive statistician, especially under difficult conditions and are unable to calculate the odds properly when making investments choices. III. Investors are swamped with information and they react to this avalanche of data by adopting shortcuts or rules of thumb rather than formally calculating odds of a given outcome. IV. The distortions produced by subjectively calculated probabilities are large, systematic and difficult to eliminate even when investors are fully aware of them.

222733. “Tversky and Kahneman’s findings ... lead to another rule that investors should follow”. Which rule is the author talking about? I. Not to be influenced by short term and occasional record of a money manager, broker, analysts, or advisor, no matter how impressive. II. To accept cursory economic or investment news without significant substantiation but supported by statistical evidence even if limited in data sufficiency. III. In making decisions we become overly immersed in the details of a particular situation and consider all the outcomes of similar experience in our past. IV. None of the above.

222734. According to the passage which statement written below is farthest in explaining the meaning of the passage above? I. Market letter writers have been wrong in their judgments many a times but they continue to express their opinion as dramatic predictions and well time call results in huge rewards to analysts, journalist and popular writers. II. Public opinion polls are fairly accurate because they are based on randomly selected diminutive representative groups and hence are more meaningful than intuitive statistics of an outcome. III. People generally limit the need for hefty statistical evidence as it satisfies their intuition without reflecting the reality. IV. None of the above.

222735.

When people react to their experiences with particular authorities, those authorities and the organizations or institutions that they represent often benefit if the people involved begin with high levels of commitment to the organization or institution represented by the authorities. First, in his studies of people's attitudes toward political and legal institutions, Tyler found that attitudes after an experience with the institution were strongly affected by prior attitudes. Single experiences influence post- experience loyalty but certainly do not overwhelm the relationship between pre-experience and post- experience loyalty. Thus, the best predictor of loyalty after an experience is usually loyalty before that experience. Second, people with prior loyalty to the organization or institution judge their dealings with the organization’s or institution's authorities to be fairer than do those with less prior loyalty, either because they are more fairly treated or because they interpret equivalent treatment as fairer.Although high levels of prior organizational or institutional commitment are generally beneficial to the organization or institution, under certain conditions high levels of prior commitment may actually sow the seeds of reduced commitment. When previously committed individuals feel that they were treated unfavourably or unfairly during some experience with the organization or institution, they may show an especially sharp decline in commitment. Two studies were designed to test this hypothesis, which, if confirmed, would suggest that organizational or institutional commitment has risks, as well as benefits. At least three psychological models offer predictions of how individuals’ reactions may vary as a function of a: their prior level of commitment and b: the favorability of the encounter with the organization or institution. Favorability of the encounter is determined by the outcome of the encounter and the fairness or appropriateness of the procedures used to allocate outcomes during the encounter. First, the instrumental prediction is that because people are mainly concerned with receiving desired outcomes from their encounters with organizations, changes in their level of commitment will depend primarily on the favorability of the encounter. Second, the assimilation prediction is that individuals' prior attitudes predispose them to react in a way that is consistent with their prior attitudes.The third prediction, derived from the group-value model of justice, pertains to how people with high prior commitment will react when they feel that they have been treated unfavorably or unfairly during some encounter with the organization or institution. Fair treatment by the other party symbolizes to people that they are being dealt with in a dignified and respectful way, thereby bolstering their sense of self-identity and self-worth. However, people will become quite distressed and react quite negatively if they feel that they have been treated unfairly by the other party to the relationship. The group-value model suggests that people value the information they receive that helps them to define themselves and to view themselves favorably. According to the instrumental viewpoint, people are primarily concerned with the more material or tangible resources received from the relationship. Empirical support for the group-value model has implications for a variety of important issues, including the determinants of commitment, satisfaction, organizational citizenship, and rule following. Determinants of procedural fairness include structural or interpersonal factors. For example, structural determinants refer to such things as whether decisions were made by neutral, fact-finding authorities who used legitimate decision-making criteria. The primary purpose of the study was to examine the interactive effect of individuals a: commitment to an organization or institution prior to some encounter and b: perceptions of how fairly they were treated during the encounter, on the change in their level of commitment. A basic assumption of the group-value model is that people generally value their relationships with people, groups, organizations, and institutions and therefore value fair treatment from the other party to the relationship. Specifically, highly committed members should have especially negative reactions to feeling that they were treated unfairly, more so than a: less- committed group members or b: highly committed members who felt that they were fairly treated.The prediction that people will react especially negatively when they previously felt highly committed but felt that they were treated unfairly also is consistent with the literature on psychological contracts. Rousseau suggested that, over time, the members of work organizations develop feelings of entitlement, i.e., perceived obligations that their employers have toward them. Those who are highly committed to the organization believe that they are fulfilling their contract obligations. However, if the organization acted unfairly, then highly committed individuals are likely to believe that the organization did not live up to its end of the bargain.The hypothesis mentioned in the passage tests at least one of the following ideas.

222736. There is only one term in the left column which matches with the options given in the second column. Identify the correct pair from the following table:

222738. In the annals of investing, Warren Buffett stands alone. Starting from scratch, simply by picking stocks and companies for investment, Buffett amassed one of the epochal fortunes of the twentieth century. Over a period of four decades more than enough to iron out the effects of fortuitous rolls of the dice, Buffett outperformed the stock market, by a stunning margin and without taking undue risks or suffering a single losing year. Buffett did this in markets bullish and bearish and through economies fat and lean, from the Eisenhower years to Bill Clinton, from the l950s to the l990s, from saddle shoes and Vietnam to junk bonds and the information age. Over the broad sweep of postwar America, as the major stock averages advanced by 11 percent or so a year, Buffett racked up a compounded annual gain of 29.2 percent. The uniqueness of this achievement is more significant in that it was the fruit of old-fashioned, long-term investing. Wall Street’s modern financiers got rich by exploiting their control of the public's money: their essential trick was to take in and sell out the public at opportune moments. Buffett shunned this game, as well as the more venal excesses for which Wall Street is deservedly famous. In effect, he rediscovered the art of pure capitalism, a cold-blooded sport, but a fair one. Buffett began his career, working out his study in Omaha in 1956. His grasp of simple verities gave rise to a drama that would recur throughout his life. Long before those pilgrimages to Omaha, long before Buffett had a record, he would stand in a comer at college parties, baby-faced and bright-eyed, holding forth on the universe as a dozen or two of his older, drunken fraternity brothers crowded around. A few years later, when these friends had metamorphosed into young associates starting out on Wall Street, the ritual was the same. Buffett, the youngest of the group, would plop himself in a big, broad club chair and expound on finance while the others sat at his feet. On Wall Street, his homespun manner made him a cult figure. Where finance was so forbiddingly complex, Buffett could explain it like a general-store clerk discussing the weather. He never forgot that underneath each stock and bond, no matter how arcane, there lay a tangible, ordinary business. Beneath the jargon of Wall Street, he seemed to unearth a street from small-town America. In such a complex age, what was stunning about Buffett was his applicability. Most of what Buffett did was imitable by the average person (this is why the multitudes flocked to Omaha). It is curious irony that as more Americans acquired an interest in investing, Wall Street became more complex and more forbidding than ever. Buffett was born in the midst of depression. The depression cast a long shadow on Americans, but the post war prosperity eclipsed it. Unlike the modern portfolio manager, whose mind- set is that of a trader, Buffett risked his capital on the long term growth of a few select businesses. In this, he resembled the magnates of a previous age, such as J P Morgan Sr.As Jack Newfield wrote of Robert Kennedy, Buffett was not a hero, only a hope; not a myth, only a man. Despite his broad wit, he was strangely stunted. When he went to Paris, his only reaction was that he had no interest in sight-seeing and that the food was better in Omaha. His talent sprang from his unrivaled independence of mind and ability to focus on his work and shut out the world, yet those same qualities exacted a toll. Once, when Buffett was visiting the publisher Katharine Graham on Martha’s Vineyard, a friend remarked on the beauty of the sunset. Buffett replied that he hadn't focused on it, as though it were necessary for him to exert a deliberate act of concentration to "focus" on a sunset. Even at his California beachfront vacation home, Buffett would work every day for weeks and not go near the water. Like other prodigies, he paid a price. Having been raised in a home with more than its share of demons, he lived within an emotional fortress. The few people who shared his office had no knowledge of the inner man, even after decades. Even his children could scarcely recall a time when he broke through his surface calm and showed some feeling. Though part of him is a showman or preacher, he is essentially a private person. Peter Lynch, the mutual-fund wizard, visited Buffett in the 1980s and was struck by the tranquility in his inner sanctum. His archives, neatly alphabetized in metal filing cabinets, looked as files had in another era. He had no armies of traders, no rows of electronic screens, as Lynch did. Buffett had no price charts, no computer - only a newspaper clipping from 1929 and an antique ticker under a glass dome. The two of them paced the floor, recounting their storied histories, what they had bought, what they had sold. Where Lynch had kicked out his losers every few weeks, Buffett had owned mostly the same few stocks for years and years. Lynch felt a pang, as though he had traveled back in time. Buffett’s one concession to modernity is a private jet. Otherwise, he derives little pleasure from spending his fabulous wealth. He has no art collection or snazzy car, and he has never lost his taste for hamburgers. He lives in a commonplace house on a tree-lined block, on the same street where he works. His consuming passion - and pleasure - is his work, or, as he calls it, his canvas. It is there that he revealed the secrets of his trade, and left a self-portrait.“Saddle shoes and Vietnam”, as expressed in the passage, refers to: I. Denier cri and Vietnam war II. Growth of leather footwear industry and Vietnam shoe controversy III. Modern U.S. population and traditional expatriates IV. Industrial revolution and Vietnam Olympics V. Fashion and Politics

222739. Identify the correct sequence: I. Depression -> Eisenhower -> Microsoft II. California -> New York -> Omaha III. J.P.Morgan -> Buffett -> Bill Gates IV. Mutual funds -> Hedge funds -> Brokers

222740. Choose the most appropriate answer: according to the author, Warren Buffett was I. Simple and outmoded II. Against planned economy and technology III. Deadpan IV. Spiritually raw

222741.

From the given pair of words select the most appropriate pair that fills the gaps and makes the sentence more meaningful.These issues are extremely ______________ and any knee jerk reaction will ultimately result in a loss of ____________ for all shareholders.

222742.

From the given pair of words select the most appropriate pair that fills the gaps and makes the sentence more meaningful.Growth under this government has been _________ high and remarkably ____________ even during the worst global economic crisis.

222743.

From the given pair of words select the most appropriate pair that fills the gaps and makes the sentence more meaningful.There are different and _______ versions about what happened in the city, but one thing is certain: it is a dastardly act that must be condemned _________

222744.

From the given pair of words select the most appropriate pair that fills the gaps and makes the sentence more meaningful.They _________ their seats away from the curved wall panels to give themselves more space as the flight attendant brought drinks from the gallery, which was _________ with family’s favorite snacks and beverages.

222745.

From the given pair of words select the most appropriate pair that fills the gaps and makes the sentence more meaningful.Cairn cannot __________ bring into picture some _________ outsider which has little experience and necessary consents to deal in the oil field.

222746.

From the given pair of words select the most appropriate pair that fills the gaps and makes the sentence more meaningful.Economic growth is on auto-pilot, unlikely to be derailed by any lapse into __________ and controls or to be _____________ by serious policy reforms.

222747.

Each sentence has a part which is underlined. Beneath the sentence you will find four ways of phrasing the underlined part. Follow the requirements of the standard written English to choose your answer. Selection should make the sentence clear, exact and free of grammatical error. It should minimize awkwardness, ambiguity and redundancy.Large and experienced firms are more efficient at acquiring smaller and distressed firms than are large and inexperienced firms, and converting them to profitable ventures.

222748. The economic growth increased from 7 to 9 per cent in November 2010, supporting the expectations that industrial growth rate in October-December quarter more than doubled that of the 4 per cent growth rate in industrial growth for the previous quarter.

222749. As a result of surging financial greed, the international rating agencies upgraded the rating of the credit derivative instruments, and hence analysts recommended a strong buy, ignoring the advice of Warren Buffett who warned that these instruments would prove not only dangerous but ineffective in the long run.

222750.

From the given options identify the word pair which is unrelated to the given word pair.IMPUISSANCE: DESECRATE

Powered By:Omega Web Solutions

Powered By:Omega Web Solutions© 2002-2017 Omega Education PVT LTD...Privacy | Terms And Conditions