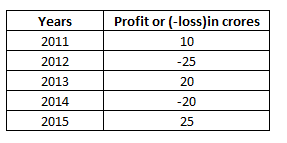

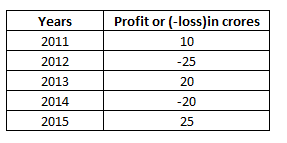

1. Read the given data and answer the questions ? What was the total profit or loss in last 5 years?

What was the total profit or loss in last 5 years?

Show Similar Question And Answers

What was the total profit or loss in last 5 years?

What was the total profit or loss in last 5 years? Powered By:Omega Web Solutions

Powered By:Omega Web Solutions