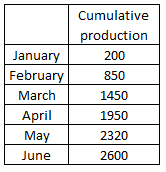

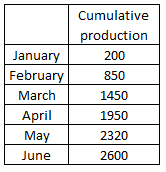

1. Refer the below data and table answer the following questions

How many car were manufactured in the month of April and May ?

How many car were manufactured in the month of April and May ?

Show Similar Question And Answers

How many car were manufactured in the month of April and May ?

How many car were manufactured in the month of April and May ?  Powered By:Omega Web Solutions

Powered By:Omega Web Solutions