1.

In the following questions, four alternatives are given for the Idiom/Phrase printed in bold in the sentence. Choose the alternative which best express the meaning of the Idiom/Phrase.The Cauvery water issued led to apple of discord between the two Governments.

Show Similar Question And Answers

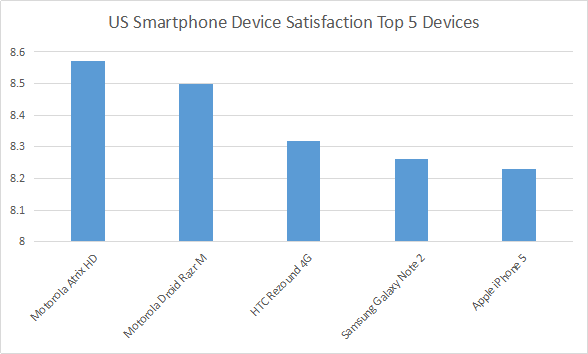

Source: 92.825 US mobile users, July 2012 - January 2013

Fortunately, those questions were answered by OnDevice Research’s representative. He explained that the survey was conducted on mobile web where the survey software could detect the taker’s device and since user’s rate their satisfaction levels on a 1 to 10 scale, thanks to the Nexus device, Google was included.If you analyze the three reports above, which of the following statements would be the best inference?

Source: 92.825 US mobile users, July 2012 - January 2013

Fortunately, those questions were answered by OnDevice Research’s representative. He explained that the survey was conducted on mobile web where the survey software could detect the taker’s device and since user’s rate their satisfaction levels on a 1 to 10 scale, thanks to the Nexus device, Google was included.If you analyze the three reports above, which of the following statements would be the best inference? Powered By:Omega Web Solutions

Powered By:Omega Web Solutions