1. In order to resolve the conflicting preferences, one of Dev’s friends suggested Dev, his family members and the HR manager to identify their most and the least preferred candidates without considering the concerns of other stakeholders. I. Dev’s most and least preferred candidates: Bal Singh and Chetan respectively II. Family members’ most and least preferred candidates: Bal Singh and Chintan respectively III. HR manager’s most and least preferred candidates: Chethan and Bal Singh respectively Which of the above three statements is/are in conformity with the information provided in the passage?

Show Similar Question And Answers

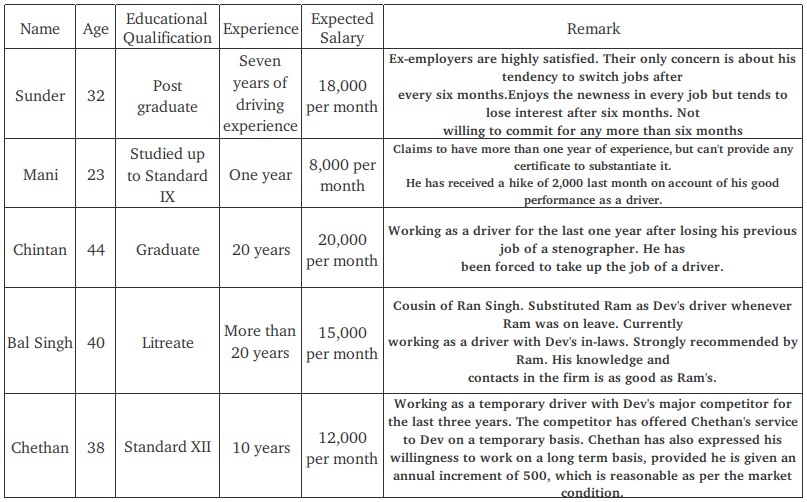

Dev is primarily looking for a stable and trustworthy driver, who can be a suitable replacement for Ram. His family members do not want Dev to appoint a young driver, as most of them are inexperienced. Dev’s driver is an employee of the firm and hence the appointment has to be routed through the HR manager of the firm. The HR manager prefers to maintain parity among all employees of the firm. He also needs to ensure that the selection of a new driver does not lead to discontent among the senior employees of the firm.

From his perspective, and taking into account the family’s concerns, Mr. Dev would like to have

Dev is primarily looking for a stable and trustworthy driver, who can be a suitable replacement for Ram. His family members do not want Dev to appoint a young driver, as most of them are inexperienced. Dev’s driver is an employee of the firm and hence the appointment has to be routed through the HR manager of the firm. The HR manager prefers to maintain parity among all employees of the firm. He also needs to ensure that the selection of a new driver does not lead to discontent among the senior employees of the firm.

From his perspective, and taking into account the family’s concerns, Mr. Dev would like to have Powered By:Omega Web Solutions

Powered By:Omega Web Solutions